When considering the options: to lease, or to finance, there are many different things to consider. When looking at GoAuto.ca, the website presents two sets of data for what to compare when choosing to lease or finance.

Figure 1. By GoAuto: Car Lease or Finance p. 3

| Is leasing better for me? You Want To drive a new car every two or three years Lower monthly payments The latest safety features and a car always under warranty You Don’t Mind Trading in or selling used cars privately Building ownership equity You Have A stable, predictable lifestyle An average number of miles to drive No problem properly maintaining your car If this sounds like you, then leasing may be the best option for your needs | Is financing better for me? You Want To build up trade-in or resale value (equity) Complete ownership of your car The feeling of being payment-free after paying off your loan The freedom to customize your car To drive your car for a long time You Don’t Mind Unexpected repair costs after your warranty has expired Higher monthly payments You Have To drive more-than-average miles Possible lifestyle changes in the near future If you prefer to own your vehicle outright, and plan to own for the long-term, then financing will be your best option |

(GoAuto “Lease or Finance…” 2021)

When looking at Go Auto’s analogy on leasing and financing, considering the price and maintenance for which option chosen can differ based on each individual. Looking at Srabana Dasgupta’s Structural Model of Consumer’s Vehicle and Contract Choice Decisions, “financial contracts require consumers to make trade-offs among financial elements, such as interest rates, monthly payments, and contract length, and nonprice components, such as maintenance costs and operating costs” (Dasgupta, 2007).

With this argument in mind, these factors can greatly change the choices a person may make when faced with the decision to finance or lease their vehicle. In today’s article, the factors and overview of both leasing and financing will be focused on to get an idea on what works best for new car owners.

GETTING STARTED ON A LEASE

To begin, think about what needs do you have long term. Google defines a “lease” specifically as “a contractual arrangement calling for the user to pay the owner for use of an asset. Property, buildings and vehicles are common assets that are leased. Industrial or business equipment is also leased. Broadly put, a lease agreement is a contract between two parties: the lessor and the lessee” (Wikipedia, 2021).

The asset in which belongs to the dealership, has to be taken care of as a borrowed item. Think of it as a library book, but with costs entitled to verify that the item returns back safely. Some drivers want the opportunity to drive the car of their dreams, and a lease provides this option without completely emptying your bank account.

A vehicle lease , as stated by select dealerships such as Toyota usually comes down to what credit score, valid government issued driver’s license, a void cheque, an up-to-date pay stub, and proof of a stable and sufficient job position. All these things may seem tedious, but it is like paying a rent, versus a mortgage.

Rents are cheaper, convenient due to the ease of paying monthly without all the necessary hassle of a landlord (bills, maintenance etc.) and this applies to a lease just as similarly. If a driver wants the convenience of being able to maintain their vehicle for a cheaper price, and drive in style with a new vehicle every 2-3 years, leasing can open a lot of doors.

DECIDING TO FINANCE

According to Wikipedia (2021), A “Car finance refers to the various financial products which allow someone to acquire a car.” Unlike leasing, financing a car comes with more responsibility, but much more freedom with your new vehicle.

Financing a car is similar to a car loan, but the outcome is that you own your car at the end.

Here are some of the requirements (in accordance to CanadaDrives, 2021):

- Government issued identification.

- Proof of residency.

- Proof of income.

- Proof of car insurance.

- Be the age of majority in your province or territory.

- Consent to a credit rating check.

Although leasing and financing requirements seem the same, the buyer has to keep in mind that the regular payments will be higher for a financed car. The period of payment is similar to a mortgage, but just like the place of residency, the vehicle of choice will be the buyers’ for the keeping.

Financing is a great option for families, business owners, and even learner drivers that want to get something to train and keep for the long run. Especially for learners, having a leased car over a financed car can be a huge risk. If an accident occurs, the price of repairing and paying back a leased car could potentially put someone into greater debt than it would for someone taking out a car loan, and financing a car. But these are just a few factors to think about. The numbers in the next section is where things become more complex.

COMPARING THE TWO: LEASE OR FINANCE

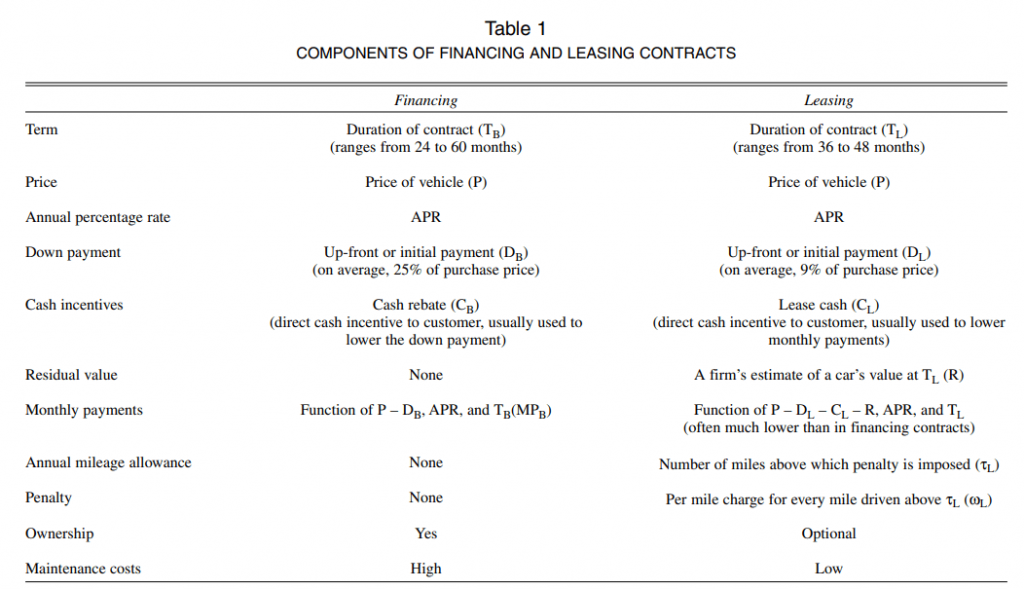

Figure 2. Table of Leasing versus Financing p. 492 (Dasgupta, 2007).

The following table exhibits some of the more broken down expenses of getting a lease, over financing, and vice versa. Dasgupta mentions following this table on p. 491, 492.

Lessees tend to drive newer vehicles and incur lower maintenance costs than buyers. Second, it is easier to dispose of a used car that is leased because the lessee can return it to the manufacturer and avoid the inconvenience and risk associated with selling the used vehicle. Finally, a disadvantage of leases relative to financing is lack of ownership; a consumer does not own the vehicle, even after making all the required payments. Note that insurance costs do not differ across leased and purchased vehicles and therefore are irrelevant. (Dasgupta, 2007).

As mentioned, although lessees tend to have the option to buy out their vehicle, the price can be a lot more alarming than having a payment plan set up for you through financing. The lack of ownership with having a new vehicle can be very disheartening, even though the vehicle you drive looks pristine and can be more affordable short term.

CONCLUSION: LEASE OR FINANCE?

Both options for getting a lease on a car or financing a car can be something very difficult to decide. On one end, leasing gives you that shiny new car you may have always wanted, with less payment, and less commitment!

On the other end, financing gives you peace of mind that the car is in your name, and yours for keeps, regardless of it being a tad bit more pricey. It truly depends on the buyer’s preference and monetary stance to make the decision of leasing or financing, but nonetheless, having a driver’s permit, and a clean safe record of driving comes before all. Look into your drivers lessons, and nail that full license before getting ready to settle down with your new car payments.